NAILBA Certified Case Manager (NCCM)

Be an Industry Leader

NAILBA’s Case Manager certification is meeting a need in the financial services industry for consistent training and continuing education for the case management community.

Contact us before you register at learning@finseca.org, to make sure we apply member partner discounts.

New to the Nailba Case Manager Certification?

Welcome to the Nailba Case Manager certification.

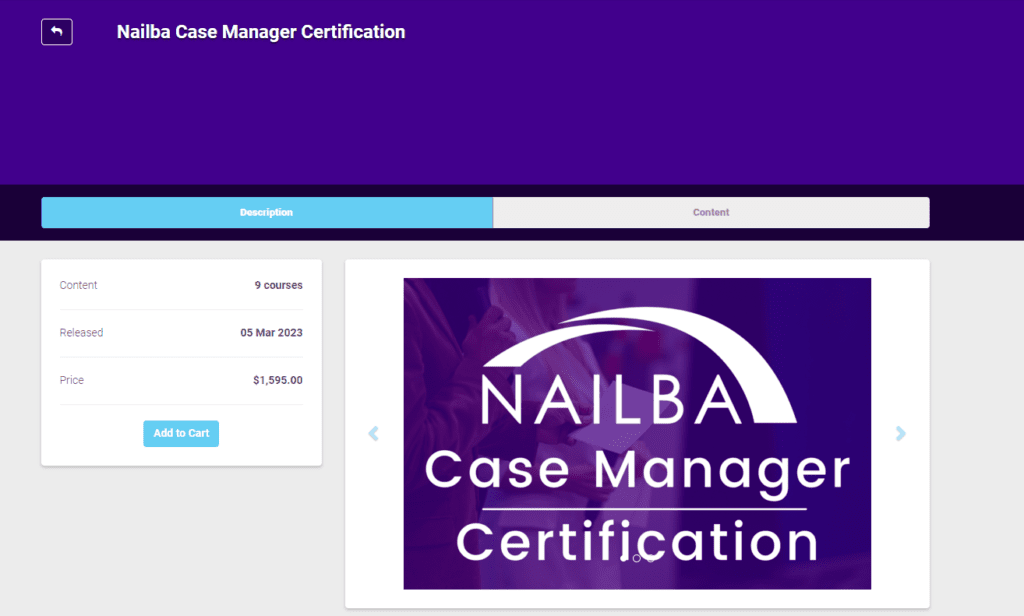

Register an Individual

- Begin by creating an account in the Finseca Learning Center. Then come back to purchase the course below!

- Once you’ve created an account you can then, Register as an Individual for the Nailba Case Manager Certification.

Register a Group

- If you’re wanting to register a group, please contact us at Learning@finseca.org for assistance!

Welcome Back!

Welcome back to the Nailba Case Manager Certification! You can continue the program where you left off or sign up for a renewal course.

Login & Resume

Ready to Renew?

NCCMs are required to renew their certification every two years (from the date of passing the final exam). To maintain the certification, NCCMs must complete four (4) continuing education courses designed for advanced case managers. These webinars will be 30-60 minutes in duration and are available on-demand.

Once the ongoing professional development requirement has been completed ($100), the NCCM renewal application fee to maintain the certification is $99. Total investment: $199.

If you’re an individual looking to renew, then enroll here. If you need help pulling up your account information, then email us at learning@finseca.org.

NEW! - Licensing & Contracting Certification

This course builds upon the foundational Case Manager Certification by exploring advanced case management best practices. It delves into the crucial aspects of Contracting, Licensing, Appointments, and Commissions, emphasizing their role in the sale and processing of life insurance policies. Developed through a life insurance lens, the program consists of 10 online learning modules accompanied by mastery quizzes.

Non-Finseca Members

- Begin by creating an account in the Finseca Learning Center. Then come back to purchase the course below!

- Once you’ve created an account you can then, Purchase the course from our Store Front.

- The first course in the series will be added to your Dashboard.

Finseca Members

- Begin by Logging in at MyFinseca.org. Once you’re signed in you can Purchase the course from our Store Front.

- The first course in the series will be added to your Dashboard.

Explore Individual Modules

Life Insurance Overview

- Part I –The Purpose of Life Insurance

- Part II – Term Insurance Products, Features, and Benefits

- Part III – Permanent Insurance Products, Features, and Benefits

- Part III – Permanent Insurance Products, Features, and Benefits Continued

- Part IV – Riders, Living Benefits, and Policy Provisions

- Part V – Life Insurance Analysis, Reviews, and Compensation

The Underwriting Process

- Part I – Underwriting Basics

- Part I – Underwriting Basics Continued

- Part II – Risk/Rate Class Overview

- Part III – Field Underwriting

- Part III – Field Underwriting Continued

- Part IV – Navigating Underwriting Decisions and Reinsurance

The Role of the Brokerage General Agency (BGA)

- The Role of the Brokerage General Agency (BGA)

Types of Case Submissions

- Part I – Preparing the Application

- Part II – Available Submission Methods

The Case Manager Role

- Part I – Principal Responsibilities and Interactions

- Part II – Skills, Personality Traits, and Performance Indicators

Case Management Requirements

- Part I – Licensing, Contracting, and Commissions

- Part II – Tracking and Documentation

- Part III – The Right Practices for Success

Working with Advisors and Insurance Professionals

- Part I – The Role of the Advisor

- Part II – The Different Business Models

- Part III – Fostering Advisor Relationships and Service

Regulatory Considerations

- Part I – Insurance Regulators, Licensing and Continuing Education

- Part II – Regulation 187 Best Interest (BI)

- Part III – Regulation 60 and Anti-Money Laundering

- PART IV – General Supervisory Requirements

What's Next?

The NAILBA Community is partnering with the Finseca Learning Team to provide you with new professional development designed exclusively for case managers. Topics will include Licensing, Underwriting, and Case Design. Stay tuned for NAILBA Case Manager Certification 2.0 in November of 2023!

Testimonials

Who is getting certified?

- AccuQuote

- AccuServices

- Advisors Excel

- Algren Associates

- American National

- Ash Brokerage

- The ASA Group

- Berson Sokol Agency

- Bitcoin

- Borden Hamman Insurance Marketing

- Brokers Central

- Brokers Clearing House

- Brokers’ Service Marketing Group

- BUA

- BUI

- The Cason Group

- Cincinnati Life Insurance Company

- Coastal Insurance Consulting

- Colorado Brokerage Group

- Collaborative Planning Group

- CreativeOne

- Crump

- Diversified Brokerage Services

- Dixon Wells

- Duncan Advisor Resources

- e4 Insurance Services

- East & Ocean Producers Group

- Element Insurance Partners

- EMG Insurance Brokerage

- Employee Pooling

- Empire Insurance Brokerage

- eNoah

- Financial Independence Group

- Finseca

- First Heartland Capital

- First Choice Brokerage

- First Financial Security, Inc.

- Georgetown Financial Group, Inc.

- Hallett Financial Group

- Highland Capital Brokerage

- Independent Planners Group

- Innovative Underwriters

- InsMax Insurance Brokerage

- Insurance Designers of America

- The Insurance Partners

- Insurance Technologies

- iPipeline

- Issue Insurance Agency

- ISTA

- Johan Inc.

- John Hancock Insurance

- KAFL Insurance Resources

- Kansas City Life Insurance Company

- KME Insurance Brokerage

- Larry Gordon Agency

- Life Brokerage Service Corp

- Lifely

- LifePro

- LifeQuotes

- Lincoln Financial Group

- LLIS

- Magellan

- Mark Wall & Company

- MassMutual

- The Merz Agency

- Millennium Brokerage Group

- The Milner Group

- The National Benefit Corp

- Northeast Brokerage

- Optima Financial & Insurance Services

- owR Opinion

- The Palmer Agency

- Partners Advantage

- Peach Insurance Services

- Pinney Insurance

- Premier Marketing

- ProducersXL

- Resource Brokerage

- The Rosenthal Agency, Inc.

- SBG

- Securian

- Southern Insurance Group

- Taber Brokerage

- Techficient

- Total Financial

- Underwriters Brokerage Service

- Valmark Financial Group